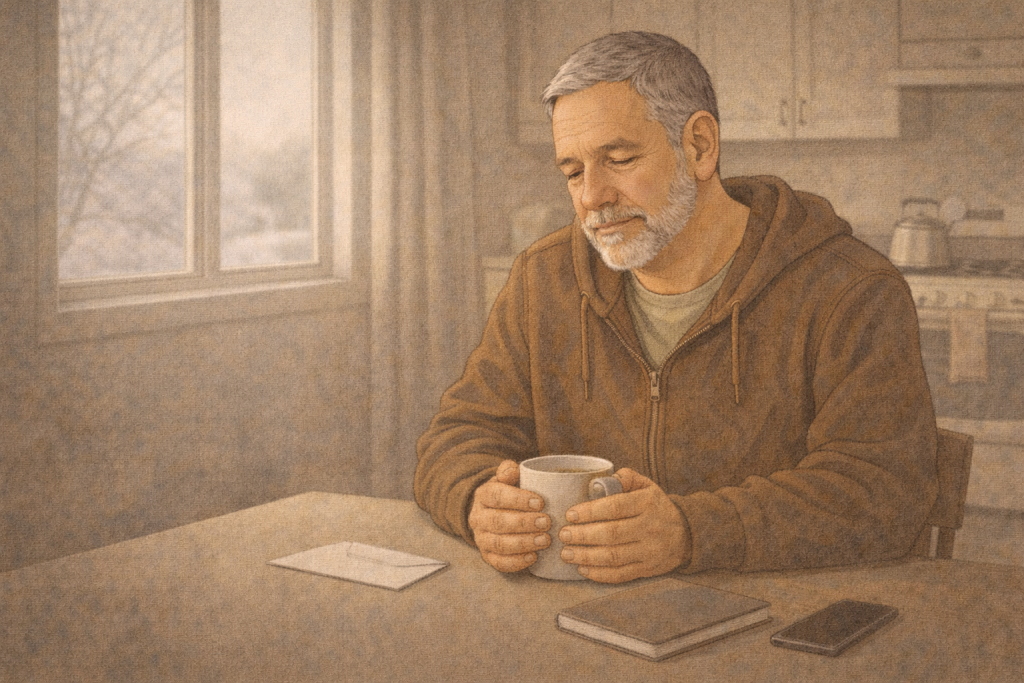

Last Monday, I woke up to collection notices and stalled projects.

Yesterday was Monday again and I woke up to confirmation that an annual renewal for a major project was moving ahead, the next phase of an ongoing project is ready for my input, and a potential new project with the same client is on the table.

Nothing materially changed overnight. There isn’t more money in my account this morning. In fact, I’ll still be watching my spending until the end of the month.

Yet my mood is lighter. My chest feels less tight. My shoulders are lower.

That’s when the question landed, again:

Why is my sense of worth so tightly wired to my pocketbook?

The Old Equation I Still Carry

Somewhere along the way, I absorbed a quiet equation:

If I’m earning, I’m okay.

If I’m not, I’ve failed.

It didn’t come from greed.

It came from survival.

When you’ve rebuilt your life more than once, money starts to feel like proof that the ground is solid beneath your feet. It becomes shorthand for safety, relevance, contribution.

So when work slows or cash tightens, it doesn’t just feel stressful.

It feels personal.

Like I’m somehow less than I was a month ago.

The Problem With That Equation

The problem is obvious when I slow down enough to look at it:

My value didn’t disappear last week.

My skills didn’t evaporate.

My character didn’t weaken.

What changed was certainty, not worth.

But my nervous system doesn’t always know the difference.

A Reframe I’m Practising

Here’s the distinction I’m working with:

- Income is feedback, not identity

- Cash flow reflects timing, not truth

- Work confirmations calm anxiety, they don’t create value

When I feel that lift after a good email, it’s not because I’ve become more worthy.

It’s because uncertainty eased its grip.

That matters, because it tells me what actually needs tending.

A Plan to Untangle Self-Worth From Money

This isn’t a mindset switch. It’s a practice. Here’s what I’m committing to, one step at a time.

1. Name the Trigger Without Shaming It

When my mood rises or crashes around money, I pause and say:

“This is fear talking, not fact.”

No fixing. No arguing. Just naming it.

2. Separate Security From Worth

Security matters. Bills are real. Bread still needs to be bought.

But I’m practising saying:

“Feeling unsafe doesn’t mean I am unsafe.”

“Feeling broke doesn’t mean I’m broken.”

3. Anchor Worth to What Doesn’t Fluctuate

Each day, I remind myself of three things that remain true regardless of income, for example:

- I show up with integrity.

- I do work that helps people.

- I’m accountable to my values, not just my invoices.

These don’t pay bills, but they keep me from selling my soul to panic.

4. Limit Emotional Forecasting

When money anxiety shows up, my mind loves to sprint ahead.

I’m practising bringing it back to today only:

“What actually needs attention today?”

Not next month. Not the story. Just today.

5. Let Relief Be Relief, Not Proof

When good news lands, I let myself enjoy it.

But I’m working on this quiet add-on:

“This feels good and I was still worthy yesterday.”

Both can be true.

What I’m Learning

My self-worth isn’t tied to my bank balance, but my sense of safety often is.

That doesn’t make me shallow.

It makes me human, shaped by experience.

The work isn’t to pretend money doesn’t matter.

The work is to stop letting it decide who I am on any given Monday morning.

Today, I’m lighter.

Last week, I was heavier.

In both weeks, I was still me.

And that’s what I’m practising remembering.